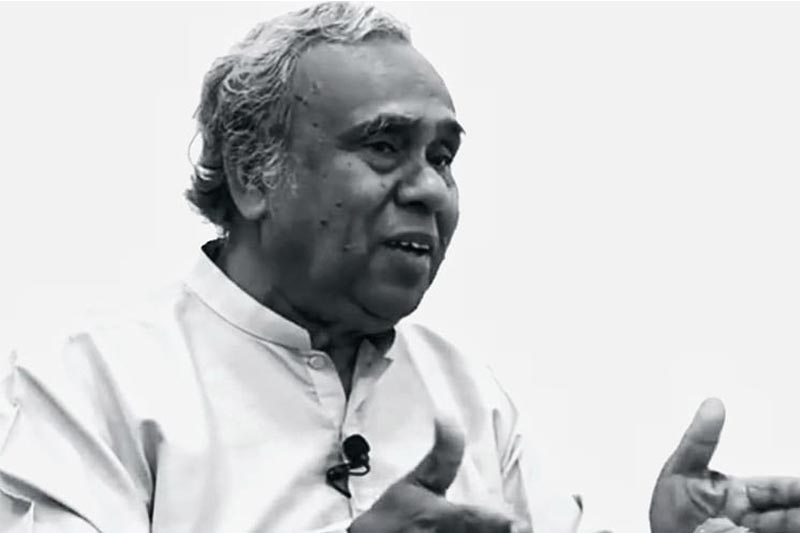

The Govenor of the Central Bank Dr. Nandalal Weerasinghe assured the public that the existing Employee Provident Fund (EPF) would remain untouched, guaranteeing a minimum interest rate of 9% for the EPF.

During a special press briefing held at the Presidential Media Centre on Domestic Debt Optimization (DDO) yesterday (29), the Governor emphasized the importance of relieving the burden on the banking system caused by the already excessive 50% taxes.

This measure aims to safeguard the treasury, strengthen the economy, and ensure the protection of the 57 million public and private bank deposits in Sri Lanka.

The Governor highlighted the severe repercussions that would result from a collapse in the country’s banking sector. To prevent such a scenario, Friday, (June 30), was declared a bank holiday until the Parliament approves the restructuring of local debt.

Speaking further he said,

"Through the restructuring of local debts, the aim is to reduce the government’s gross debt burden and meet its financial needs. If the proposed measures are implemented, it is projected that the gross financial need will decrease to 12.7, aiming for a value below 13. If successfully implemented, this would result in a reduction of public debt as a percentage of the gross domestic product, bringing it down to 90%.

As the Central Bank, our primary concern is to find the best solution to ensure the stability of the banking system and the well-being of the Employee Provident Fund (EPF). The Central Bank, being the custodian of the EPF, actively participates in discussions and supports the proposed measures to safeguard deposits and protect public funds such as the EPF from any potential harm".

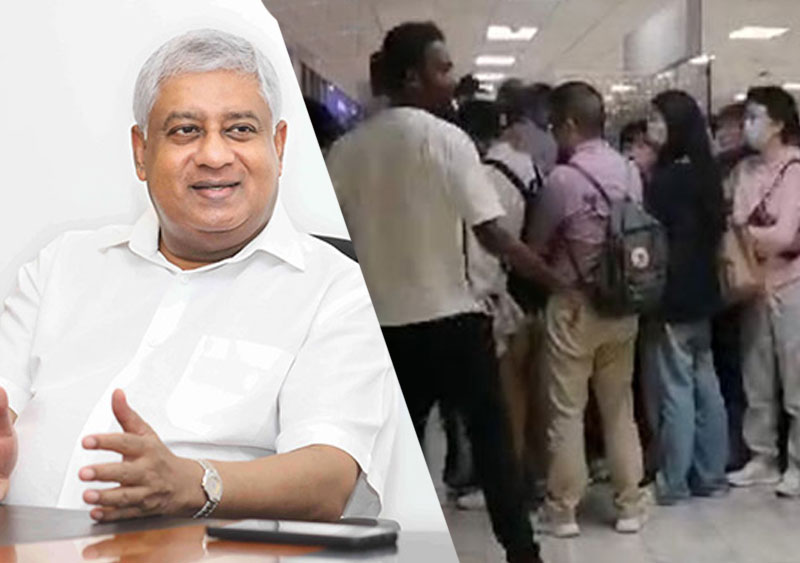

The Senior Advisor to the President on Economic Affairs Dr. R.H.S. Samaratunga, Treasury Secretary Mahinda Siriwardena and Deputy Treasury Secretary A.K. Seneviratne were also in attendance.