An academic claims the government’s plan to restructure domestic debt will not affect any dealings between banks and the customers.

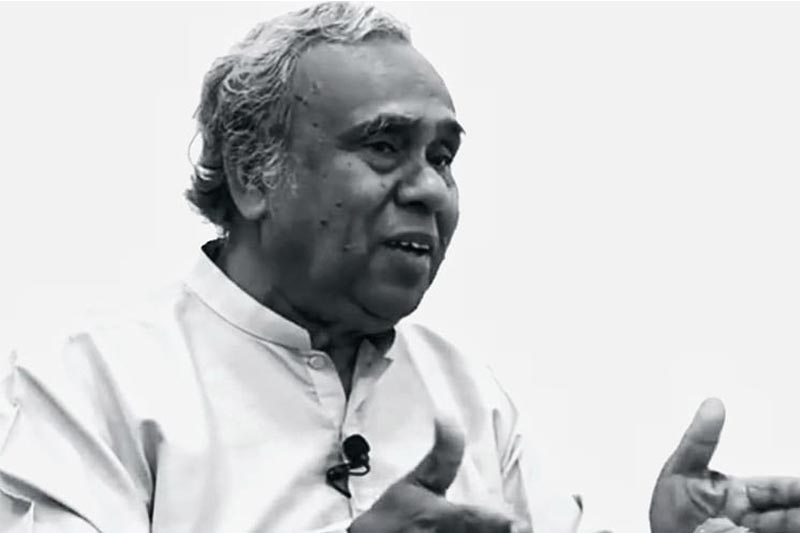

Prof. Aminda Methsila Perera, dean of business studies and finance at Wayamba University, says therefore, the public need not get worried over the process.

According to him, debt restructuring involves the deals between the government and the banks, i.e. with regard to the loans obtained by the former from the latter.

They could either be treasury bills or bonds, and if unable to repay, the government will ask for an option, either to reduce interest rates or extend the repayment period, said Perera.

In the event of a reduction of interest rates, banks would still be able to pay the agreed upon interest.

Nothing has so far been discussed about the part between the banks and the customers, he said.

Referring to the EPF, he said the interest paid in 2020 to members was between nine and 10 per cent, which could be paid continually.