Photo: BarentsObserver

The owner of Russian coal company Black Sands LLC that has been awarded a ‘dubious’ tender to supply coal to the Ceylon Electricity Board is facing corruption charges at home.

Its parent company Suek AG is one of the companies linked to Andrey Melnichenko, the wealthiest man in Russia.

He is the target of a lawsuit from the government claiming ‘corrupt collusion’ in a deal to buy an energy company, multiple reports said.

The Russian government is attempting to seize Sibeco, which has several thermal power plants in Siberia, and claims the purchase of the business by companies linked to Melnichenko from former government minister Mikhail Abyzov was corrupt, Forbes quoted Bloomberg and the Financial Times as reporting.

Abyzov was arrested months after the deal closed in 2018 and is in a Russian prison following accusations of embezzlement and defrauding shareholders of Sibeco and another company, the Financial Times reported.

Companies linked to Melnichenko bought Sibeco for 36 billion rubles, or just over $570 million at 2018’s exchange rates, according to the US government-run RadioFreeEurope/RadioLiberty news service.

A spokesperson for Melnichenko told Bloomberg the lawsuit, filed in the Russian city of Krasnoyarsk earlier this month, has been received and a hearing was scheduled for 07 September.

No other details on the government’s claims were available.

Melnichenko has moored his $300 million yacht in the United Arab Emirates and is now primarily based there.

He had a net worth of $24.4 billion as of Sunday, making him the world's 63rd-richest person and the richest from Russia.

Melnichenko founded MDM Bank, one of Russia's most successful private banks, two years after the Soviet Union fell in 1991 and went on to found fertilizer producer EuroChem and coal energy company SUEK.

The suit involving him is the latest amid a push from the Russian government to bring wealth back to the country since the start of the war in Ukraine, the Financial Times reported.

Sri Lanka coal tender deal

In Sri Lanka, the auditor general has recommended investigating the coal tender deal awarded to Black Sands LLC by the Ministry of Power and Energy subsidiary, Lanka Coal Company Pvt Ltd (LCC).

This follows the stock market disclosure by Browns PLC that together with China Machinery Engineering Corporation (CMEC), they have also sent a proposal for the coal supply tender.

The Sunday Times reported that Black Sands LLC has not managed to submit the performance bond before the stipulated timeline of September 8.

Browns PLC in its disclosure to the Stock Exchange indicated that now the award is automatically cancelled.

However, LCC officials dispute this, saying that it is not cancelled.

“One of the entities that sent unsolicited proposals has threatened to file a case against Black Sands LLC. Now, this supplier is saying that unless this issue is sorted, it will not send the coal. This entity is applying coal without any collateral. Now there is a court case against the company,” one official explained.

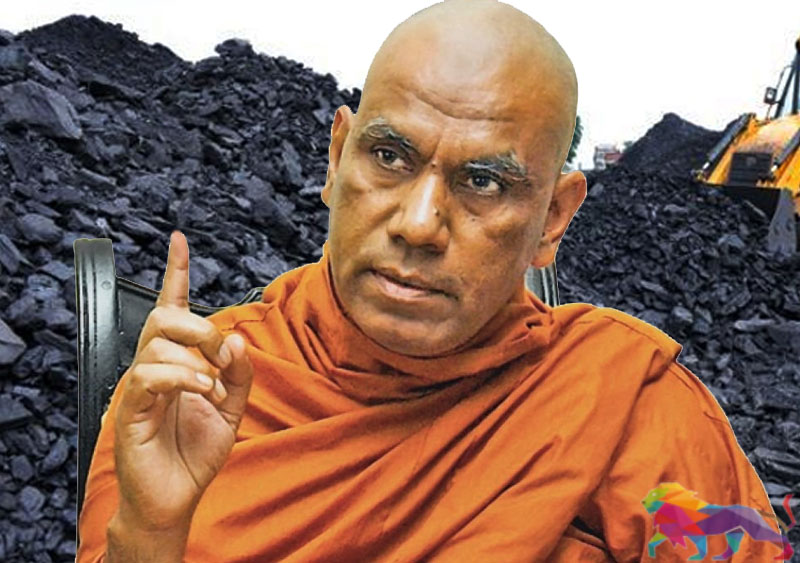

Ven. Omalpe Sobitha Thera filed a fundamental rights petition in the Supreme Court against a tender awarded to a foreign firm to supply coal

Ven. Omalpe Sobitha Thera of the Jathika Hela Urumaya has filed a fundamental rights case in the Supreme Court challenging the controversial coal deal and the process of awarding it.

“With all this, the supplier says that if he cannot get the shipment across with the court saying that it is illegal, he will not be getting the money,” an LCC official told the Business Times.

He insisted that the offer is still valid and that the supplier needs assurance to go ahead with it.

However, Browns officials insist that the award is annulled because now there is no tender procedure.

“The selected company has not submitted the performance bond to the People’s Bank. If the company was concerned about a legal issue, why did they wait till the last moment on September 7 to say that they were not participating?” a Browns official asked.

The LCC official said that Black Sands LLC was trying to get the performance bond from the bank till the last day. He said Browns and CMEC sent an original proposal quoting a freight rate at US $ 98 per metric tonne, which is a very high price.

“In their second proposal, the joint venture entities have said that the freight rate is the buyer’s responsibility. They did not give a cost-plus freight price or a cfr.”

In the subsequent proposal Browns and CMEC has reduced freight rates to US$30 per metric tonne, a Browns official said.

LCC, in a letter dated August 2nd, has intimated to the Technical Evaluation Committee of the Ceylon Electricity Board that there are four unsolicited proposals, of which Suek AG is one. Black Sands LLC represents Suek AG in the solicited proposals.

When queried whether one party can submit two proposals, one solicited and the other unsolicited, the LCC official said they were trying to get a government-to-government (G-to-G) proposal.

“The unsolicited proposal was a government-to-government one where we tried getting coal directly from a government, but they said that since they do not have state owned coal mines, they did not consider G-to-G. Also, one party can submit a solicited and an unsolicited proposal. It is not a problem.”

He also added that the country is looking at least at eight to 10 hours of power cuts if this deal does not go through.

The 4.5 million MT tender is the largest awarded for coal in Sri Lanka to date.

Brown’s officials accede that it is a national issue and also say that if the country gets a better deal than what they along with CMEC offered, they will accept it.

Related News:

Omalpe Thera petitions court against coal tender