Inland Revenue, Excise and the Customs are the three departments tasked with collecting tax revenue on behalf of the state.

State revenue declined in 2022 to 8.2 per cent of the GDP, from more than 20 pc two decades ago.

A parliamentary committee has said in a report the country’s revenue was ranked third lowest out of 193 nations during that year.

Although tax revenue was projected to be 91 pc of state revenue in 2023, its first half has seen a discouraging failure in tax collection.

Inland revenue collected only 42 pc, excise 41 pc and customs 33 pc.

As at end-2022, unpaid taxes due to the Inland Revenue Department stood at Rs. 904 billion.

It was 6.71 billion for the Customs and Rs. six billion for the Excise Department by end-June 2023.

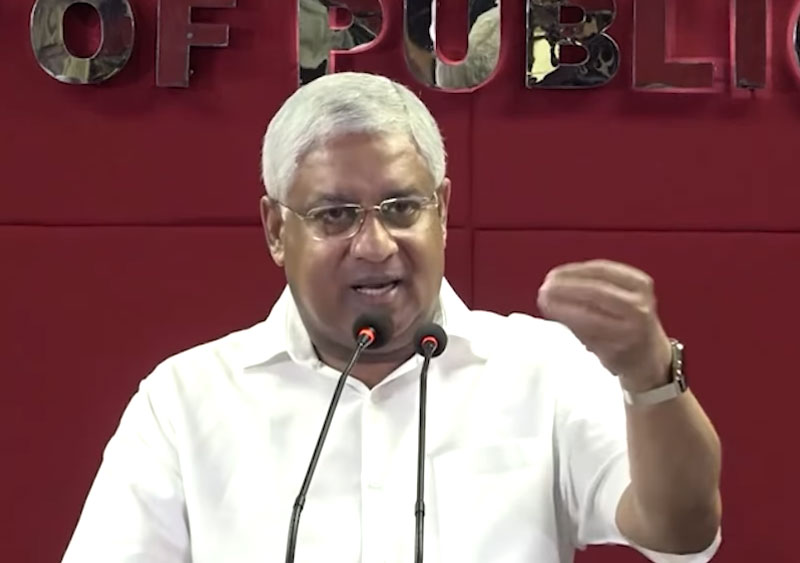

Chairman of the parliamentary committee on ways and means Patali Champika Ranawaka has told BBC Sinhala Service the Inland Revenue Department has yet to give a list of the defaulters despite repeated requests.

Committee on ways and means

Established under Standing Order no. 124, this committee comprises 17 MPs, who are empowered to call for any report and inspect any institution.

This committee is tasked with recommending measures to raise state revenue and to ensure the smooth functioning of welfare and disaster relief mechanisms.

Its first report has raised several concerns.

One is that 45 pc are evading the tax net.

A mere three pc of the total population pays taxes.

The committee has suggested measures on how to include 45 pc that should be paying income tax.

Ranawaka also said Sri Lanka was one among the only six countries that do not tax digital services.

Taxes cannot be levied on Uber, Facebook, YouTube etc.

The committee report has also mentioned an annual loss of two billion US dollars to tax evasion in foreign trade and remittances not being sent home.

A 2009 presidential commission on taxation has recommended a 60 : 40 ratio between direct and indirect taxes from the still existent 20 : 80 ratio.

QR code for liquor bottles

Sri Lanka has 23 registered distilleries, but 73 pc of the excise income comes from two major producers.

These two use an emblem visible only under ultraviolet light, while 21 producers paste an excise tax sticker on liquor bottles.

The committee report recommends a uniform method in this regard to minimize tax evasion.

Also, steps to ensure the Treasury duly receives the taxes and for the buyer to find out if the liquor bottle he has bought has met all quality and tax standards have been endorsed.

Following instructions by this committee, the Excise Department this year started raids and seized more than 44,000 bottles without a safety sticker, and collected nearly Rs. 40 million in fines from one producer.

A combined revenue management method proposed by COPA in 2016 is yet to materialize.

There is no coordination between the RMV, inland revenue and the registrar of companies, with each having different identification numbers for a single taxpayer, said Ranawaka.

As a solution, the committee has suggested to join 13 state agencies together to minimize tax income losses, he said.

With regard to disaster management, it has found the national council for disaster management has not met for 10 long years.

(With inputs from BBC Sinhala Service)