Justice, Prisons Affairs, and Constitutional Reforms Minister Dr. Wijeyadasa Rajapakshe yesterday (27) assured that necessary amendments

to parate law to give effect to the temporary freeze of recovery action will be presented in Parliament soon.

”The proposed legislative change signifies a proactive approach towards addressing legal matters crucial for the country’s governance and justice system,” said Rajapakshe adding that the suspension of parate action until 15 December 2024 will give big relief to the struggling Micro, Small and Medium Enterprises.

Speaking at a media briefing the Minister Rajapakshe also announced a new Rs. 20 billion concessionary loan scheme for MSMEs via the help of the Asia Development Bank (ADB).

“This initiative aims to bolster the economic prospects of smaller businesses, contributing to overall economic resilience and growth,” the Minister added.

Through this platform, he emphasised the government’s steadfast dedication to advancing legal reforms and providing support to SMEs, thus affirming its commitment to national progress and prosperity.

Separately, the Government said at Monday’s meeting of the Cabinet of Ministers, approval was given to the proposal furnished by President Ranil Wickremesinghe in his capacity as Finance, Economic Stabilisation and National Policies Minister to suspend the procedure to acquire properties of whose loans are not paid off by the banks up to 15.12.2024 and to amend section 4 of the Recovery of Loans by Banks (Special Provisions) Act No. 4 of 1990 to impose legal provisions required for this move.

The move was following various parties pointing out issues existing in relation to properly paying off the loans obtained from the banks for the businesses by MSMEs during multiple crises in the past 4 years.

“Under such circumstances, adhering to existing legal provisions banks are taking measures to acquire properties of a considerable number of businessmen due to non-payment of loans and auction them. Therefore, it is apparent that a sufficient grace period to pay off relevant debts without being a burden to the banking system should be rendered by redressing the crisis possible to be erupted in the business arena,” the Government said.

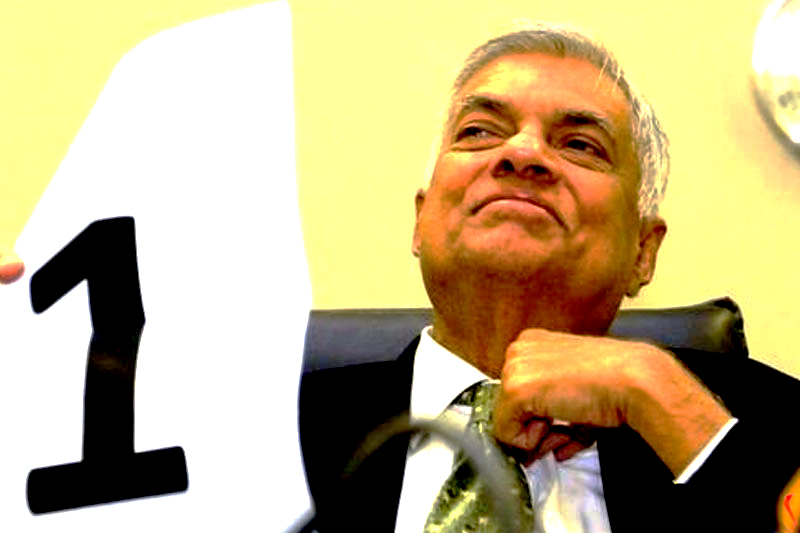

At the separate briefing at the President’s Media Division, Minister Rajapakshe also said the following.

A nation’s fiscal policy is integral to its economic strength. The Central Bank holds significant authority in shaping this policy landscape. Reflecting on discussions surrounding Parate execution in Sri Lanka, it becomes apparent that the central bank’s focus is primarily centred on safeguarding the stability of financial institutions.

However, concerns have been raised regarding whether sufficient attention has been paid to the country’s overall balance sheet, especially amidst declines in the agricultural sector from 22% to 8% and the industrial sector from 38% to 32%.

Despite borrowing from the International Monetary Fund (IMF) on 17 occasions, the economy has struggled to regain its footing. A notable trend has been the continuous expansion of the service sector at the expense of neglecting the industrial sector, resulting in decreased production capacity. This imbalance has impeded the nation’s economic recovery and overall growth trajectory.

The staggering amount of loans extended by two state banks, totalling approximately

Rs. 602 billion, presents a daunting challenge. Much of this sum is destined to be written off as bad debt due to non-payment. Had these funds been allocated towards agriculture and industry, significant strides in growth could have been achieved. This predicament underscores the necessity for stringent financial controls within the country to ensure optimal utilisation of resources and sustainable economic development.

To prevent crises for businesses and financial institutions, proactive measures are essential. Therefore, steps must be taken to alleviate the challenges associated with Parate execution. Plans are underway to propose amendments to Parliament regarding Parate execution to address these concerns. Additionally, a separate loan scheme tailored for Small and Midsize Enterprises (SMEs) is on the agenda, with President Ranil Wickremesinghe lending his support to this initiative.

Furthermore, the government aims to implement a low-interest loan program for SMEs, collaborating with key financial institutions like the World Bank and the Asian Development Bank. Recognising the importance of responsible lending, discussions with the Cabinet have led to the decision to establish a monitoring system for credit facilities. Future deliberations with the Ministry of Finance are also anticipated to refine these strategies further.

(ft.lk)