The government will be amending tax legislation soon to eliminate or restrict ministerial authority to introduce tax changes without prior parliamentary approval and ensure that such changes do not generate revenue losses.

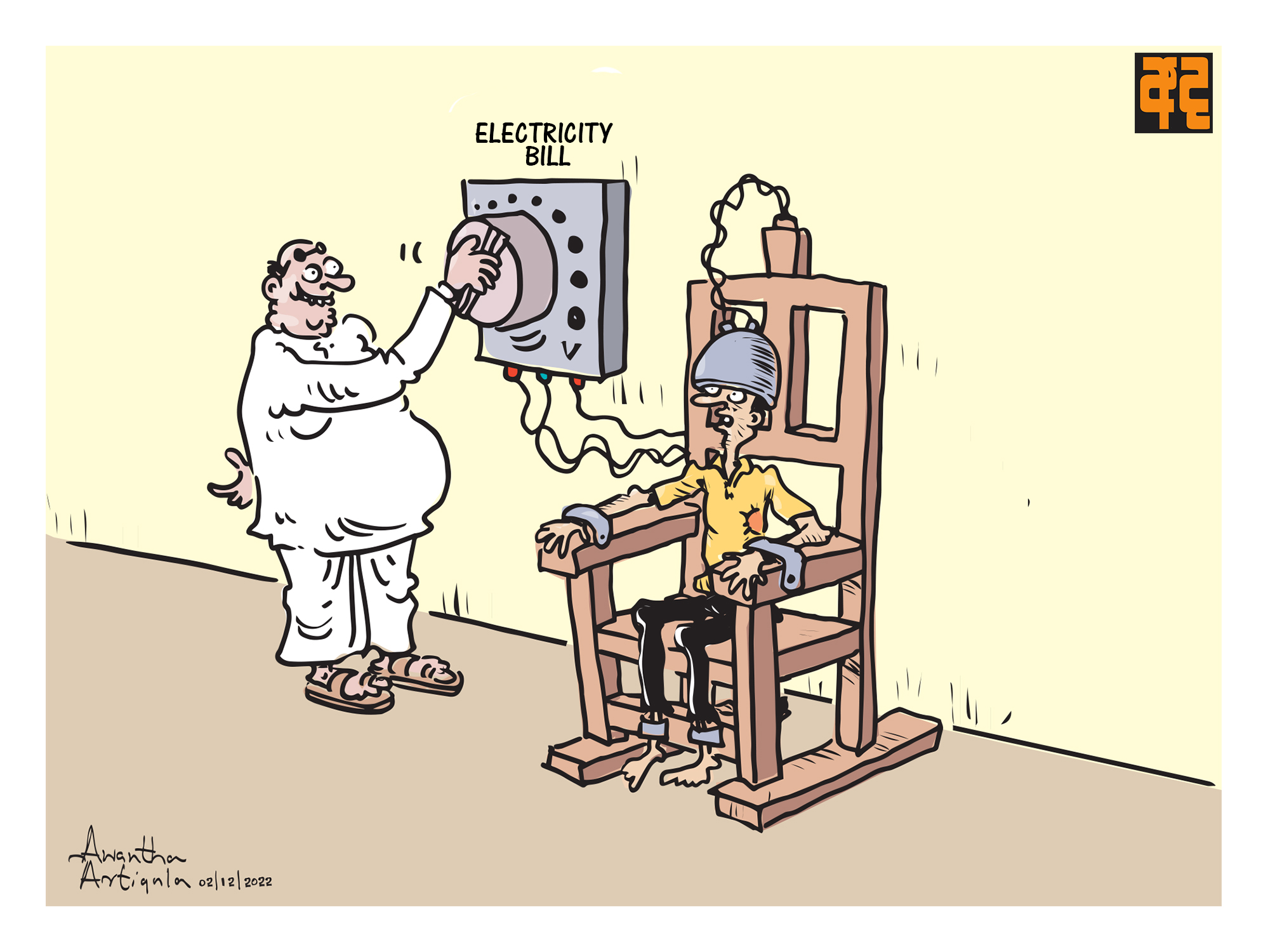

It is continuing the implementation of the progressive tax reform package introduced in May 2022, along with some tax hikes, including the Value Added Tax (VAT) maintaining exemptions on basic food and some essential items, finance ministry sources confirmed.

Commenting on this issue, former finance Minister Ravi Karunanayake said that he has some reservations on the VAT hike to 18 percent from 15 percent, exerting an unbearable impact on ordinary citizens.

He added that VAT can be reduced up to 9 percent from 18 percent by increasing several other direct taxes while recovering the accumulated tax arrears from tax doggers.

Sri Lanka plans to bring 500,000 out of some 1 million “tax evaders” who have the capacity to pay income tax into the tax net in a bid to increase direct taxation to 40 percent.

“This adjustment aligns with the conditions of developed countries and promotes social justice. In a population of one million capable taxpayers, only 500,000 individuals are currently fulfilling this obligation. Identifying tax evaders and bringing them into the tax net is crucial to reduce indirect taxes,” the former Finance Minister said.

The impact of the VAT increase to 18 percent from 15 percent is to be mitigated for the benefit of ordinary citizens with the elimination of additional taxes on goods and services under VAT and adopting necessary tax adjustments, he disclosed.

Furthermore, it was revealed that nearly 90 essential items, including educational services, electricity, health, medicine, passenger transportation, as well as all vegetables and fruits, are exempt from VAT.

Additionally, VAT does not apply to 65 types of items subject to the Special Commodity Levy.

The Finance Ministry is committed to revamping the VAT system this year, by removing almost all product specific VAT exemptions, he said, adding that it will be significantly speeding up valid VAT refunds and abolishing the Simplified VAT (SVAT) system.

The Finance Ministry has also revealed that measures will be taken to introduce a property tax, as well as a gift and inheritance tax before 2025.

These tax policy reforms focus on base-broadening and progressive measures to mobilize revenue according to the tax collection target of Rs 3.82 trillion for 2024 to three revenue collection departments while promoting economic efficiency and equity.