The Government has the right to take corrective actions in light of new developments and difficulties in the implementation of the reform programme and adjusting or wavering any International Monetary Fund (IMF) conditions which are detrimental to the country, former finance minister Ravi Karunanyake said.

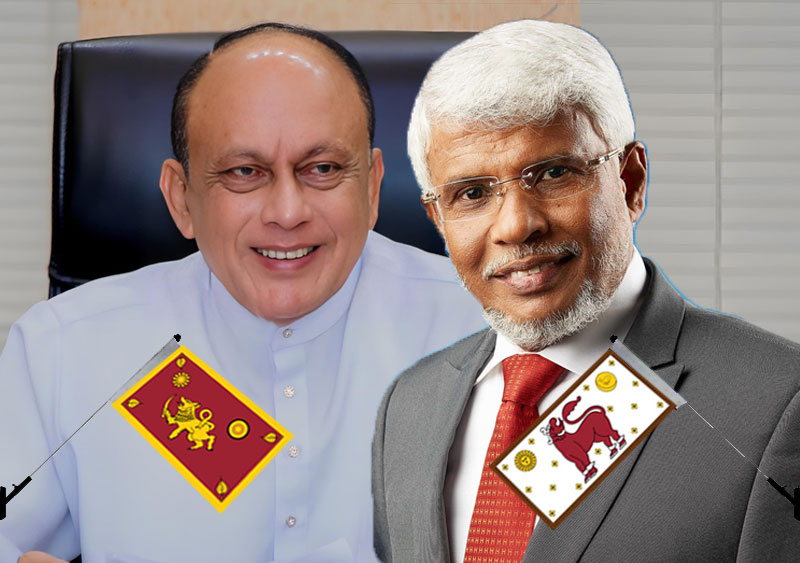

True to these views expressed by seasoned financial expert and the 'Best Finance Minister of the Year 2017 – Asia Pacific Region' Ravi Karunanayake, Senior IMF Mission Chief Peter Breuer told a media conference in Colombo recently that it is now imperative for the authorities to adopt their own action plan for implementing the recommendations in the report beyond the priority commitments under the Extended Fund Facility (EFF) .

At the same time, ensuring an enabling environment for governance and transparency reforms to take place is key to bolstering public confidence and facilitating implementation of these important efforts, he added.

When a country borrows from the IMF, the government agrees to adjust its economic policies to overcome the problems that led it to seek financial assistance.

These policy adjustments are conditions for US$ 3 billion EFF and help to ensure that the country adopts strong and effective policies.

Accordingly, the IMF staff technical team now concluded periodic programme reviews to assess whether it is on track or needs to be adjusted in light of new developments, Karunanayake said.

Sri Lankan top officials involved in negotiations with the IMF have now been given an opportunity to take corrective actions relating to current monetary or fiscal policies stipulated in the reform programme if they are detrimental to the country, he noted.

He observed that it has to be done in consultation, consensus and compromise with the IMF staff team now in the island on a fact finding mission to discuss recent developments and follow up on reform programme targets and commitments.

Former Finance Minister Karunanayake who successfully negotiated a loan of US$1.5 billion from the IMF in 2016 to boost foreign exchange reserves and avert a balance of payments problem noted that central bank and finance ministry officials should be able to negotiate the best possible conditions for the country.

However, he pointed out the responsibility of these high level officials to bring to the notice of the visiting IMF staff team on public concerns relating to tax reforms such as VAT hike and high cost of living while suggesting corrective actions.

Expressing his view on Sri Lanka’s taxation system, he emphasised that it has to be independent of IMF recommendations and fairer by rich and the middle class alike considering their earning capacity without burdening the poor via indirect taxes.

Sri Lanka's Inland Revenue Department announced that it collected a record tax revenue of Rs. 1,550.6 billion in 2023. It said that this figure is 104 percent of the revenue target set for the Department in that year.

Karunanayake noted that the government is persistently addressing the impact of the Value Added Tax revision with the exclusion of additional taxes on goods and services under VAT and implementing necessary tax adjustments.

A 3 percent hike in VAT would finance the Rs 10,000 salary increase of public sector employees numbering around 1.3 million, he claimed, adding that he also has some concerns relating to impacts of VAT on vulnerable community . .

Missed structural benchmarks and indicative targets are assessed in the context of overall programme performance by the current IMF mission.

Sri Lanka has to expedite the public debt restructuring process and implementation of government’s ambitious reform programme supported by the IMF for the recovery and rebound of the country’s economy,

As part of the IMF-supported extended fund facility arrangement, Sri Lanka has undertaken significant reforms to pave the way out of a deep economic and debt crisis.

The economy is showing tentative signs of stabilisation, supported by rapid disinflation and a significant fiscal adjustment.

Measures are being taken to rebuild fiscal credibility and to improve governance and reduce corruption vulnerabilities.

The authorities reached agreements in principle with official creditors on debt treatments consistent with program parameters and are in good faith discussions with their private creditors.

The economy has begun the transformation from primarily agriculture to higher value added industry and service sectors and has the potential to further diversify and upgrade its economic structure.

As of now, the Sri Lankan economy relies primarily on tourism, tea export, clothing, rice, and other agricultural production.