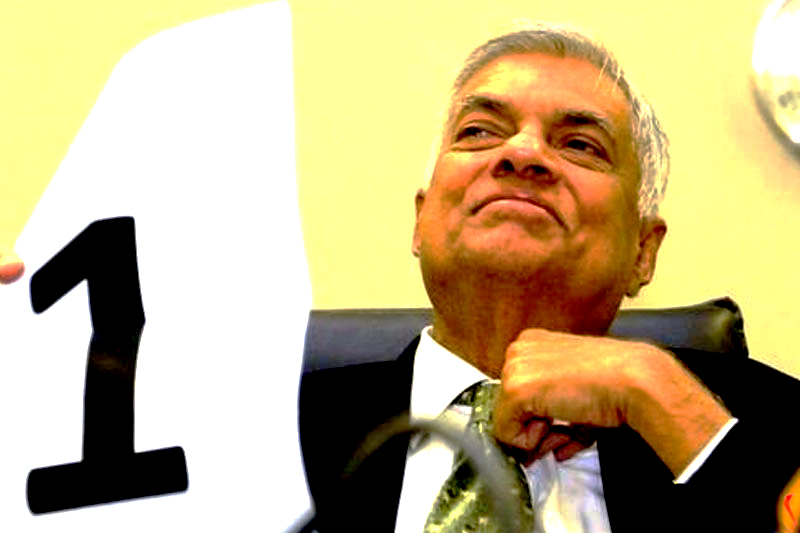

The following are 06 highlights from the proposals contained in budget 2024 presented to the House by president Ranil Wickremesinghe today (13).

1)

A Rs. 10,000 increase in cost of living allowance for 1.3 million state sector workers from January 2024, to raise it to Rs. 17,800.

It will begin to be paid from April with the payment of arrears within six months from October.

For pensioners, the CoL allowance will be increased by Rs. 2,500 to Rs. 6,025.

2)

The between six to seven per cent pension contribution from the basic salary will be increased to eight pc from April.

3)

The now–restricted contingency loan will be paid as per normal from January.

4)

The Rs. 60 billion annual allocation for Asvesuma to be raised by Rs. 183 billion and an increase in the beneficiary families to two million.

Increases in monthly allowances to persons with disabilities and kidney patients (to Rs. 7,500) and senior citizens (to Rs. 3,000).

5)

The Rs. 3,000 monthly rent for low-income families under urban housing will be scrapped and ownership given to an estimated 50,000 families in 2024.

Rs. four billion to be allotted to grant land for the construction of houses for estate dwellers.

6)

Another Rs. 1,000 million to be given to pay compensation for persons living in northern and eastern provinces affected or gone missing due to the internal conflict.

The 2024 budget proposal also outlines numerous essential initiatives aimed at enhancing tax administration and revising tax policies. Some key proposals are detailed below:

• Amendments to the Inland Revenue Act No. 24 of 2017, including the introduction of special penal provisions for individuals failing to provide requested tax returns and information.

• Implementation of stringent measures for tax audit documentation, with a time limit of 6 months for evidence within Sri Lanka and 9 months for other evidence from the date of the initial request. Failure to comply during the appeal hearing at the Tax Appeals Commission will result in disallowed submissions.

• Mandatory submission of a copy of the Tax Payer Identification Number certificate in various scenarios, such as opening a current bank account, seeking building plan approval, registering or renewing a motor vehicle license and recording or settling land or land titles.

• Introduction of a tax administration system for the Sri Lanka Excise Department, encompassing the implementation of an online licensing system for a more consumer-friendly and efficient regulatory environment, evaluation of safety features and the introduction of a new Excise Permit System.

• Policy proposals for the Sri Lanka Excise Department in the budget include the establishment of Sri Lanka Standardization for maintaining liquor quality, adjusting excise license fees based on current demand, promoting investment in new alcohol products for foreign markets, permitting the sale of selected locally produced liquor in duty-free shops and implementing the Revenue Administration System for Excise Department (RASED) by October 2024.

• For the Sri Lanka Customs Department, the budget proposes the development of risk management capabilities using modern software, the installation of a system to prevent incorrect invoicing and the identification of Key Performance Indicators (KPI) related to basic administrative functions.