The State Mortgage and Investment Bank (SMIB) was summoned before the Committee on Public Enterprises (COPE) last week under the chairmanship of Prof. Ranjith Bandara.

The audit reports of the bank for 2020 and 2021 were examined and the current performance was investigated by the committee.

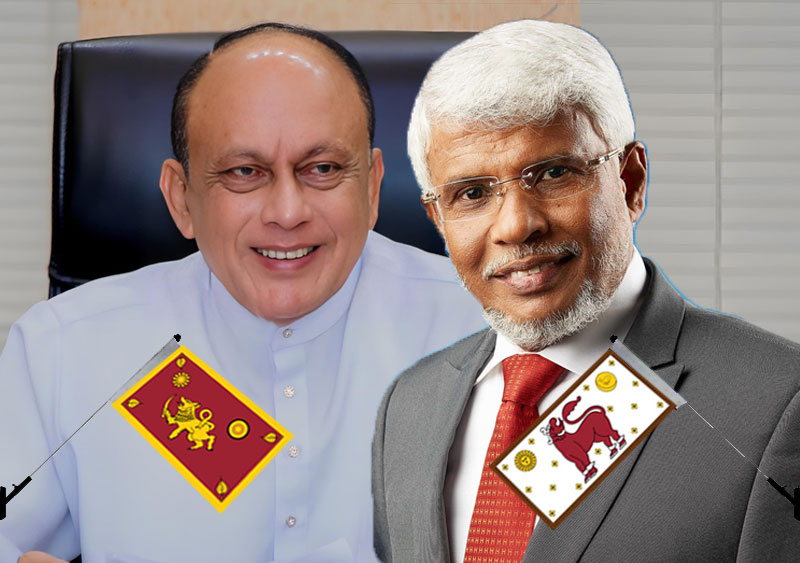

Officials representing the ministry of finance and the chairman and the general manager of the SMIB were also present.

Special attention was paid to the following points:

Delay in establishing a new core banking system

Attention was drawn towards the delay in establishing a new core banking system as per the recommendations given in the previous committee meeting. Officials assured that these works have already started and will be completed by July 2024.

The need to start operations as a competitive bank

The committee emphasized the need to improve the operations of the commercial level in order to increase the assets of the bank and reach an advanced level. The COPE chair pointed out the importance of being close to the public as a competitive bank without completely deviating from the bank's core objectives. Accordingly, the need to establish the bank's brand among the public in an innovative and attractive manner (rebranding) was emphasized.

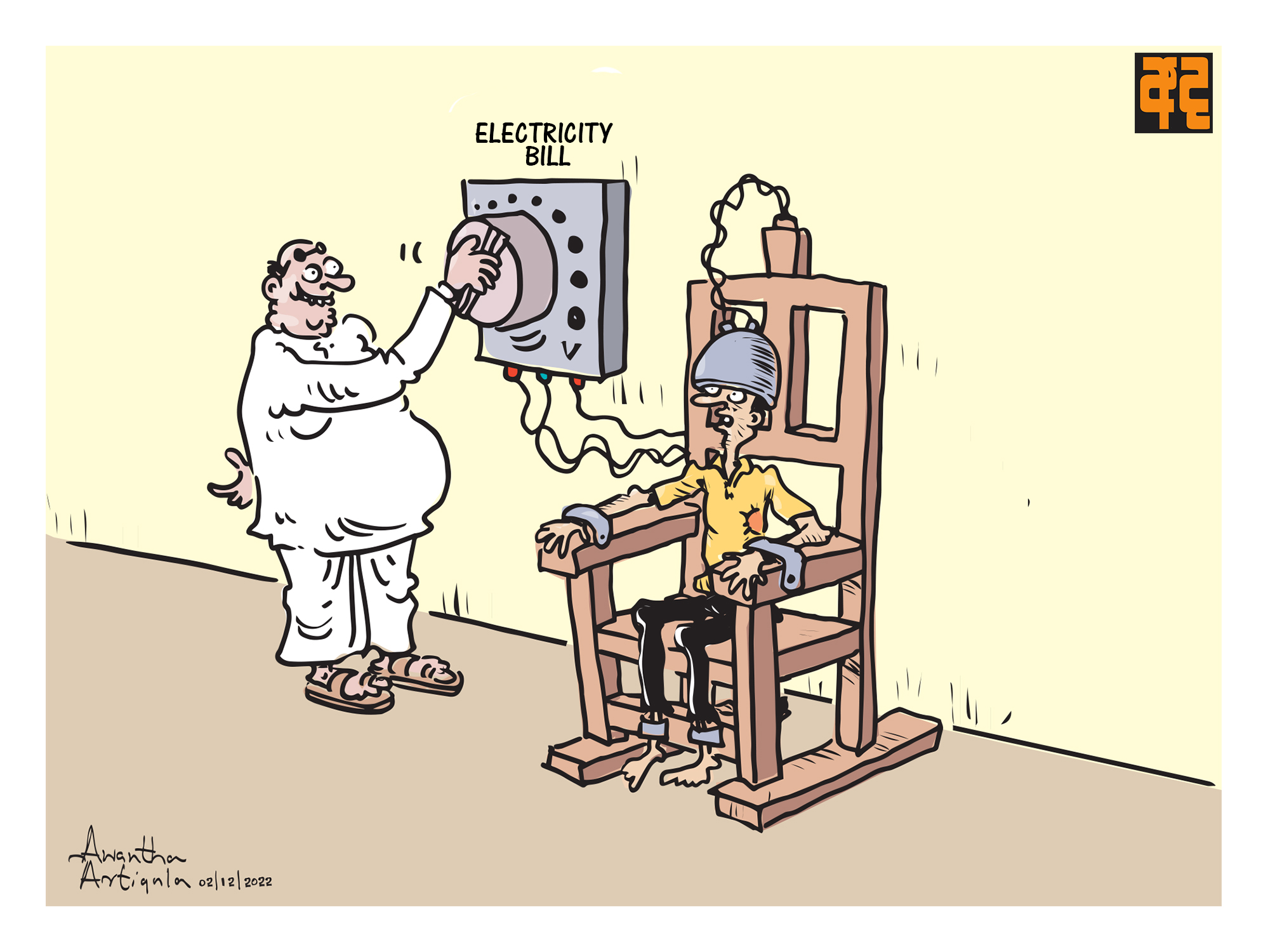

The 68-million-rupee loss due to submission of false documents

In 2017, due to the fact that some people obtained loans by submitting false documents, attention was paid to the related activities to cover the loss of 68 million rupees to the bank. It was also revealed that this fraud has taken place by giving the relevant loan amount to 49 loan applicants with the help of some officials of the bank. Officials stated that 8 million rupees have already been received aligned with legal proceedings and legal measures have been taken to obtain the remaining amount. Although 6 years have passed since this incident, officials were punished and the delay in recovering this money was given special attention. Accordingly, the COPE Chair ordered the officials to give a report on this within two weeks.

High non-performing loan ratio of the bank

Attention was drawn to the fact that 10 branches have recorded a high non-performing loan rate, exceeding the average value of the non-performing loan rate of the bank. The officers pointed out that since the majority of the customers of this bank are middle- and low-income earners, they had to be given grace periods to pay their debts due to the prevailing economic situation. Special attention was paid to this and instructions were given to take necessary steps.

State minister Janaka Wakkumbura, MPs Eran Wickramaratne, Sanjeeva Edirimanna, Sudarshana Denipitiya, Madhura Withanage, Prof. Charitha Herath were present at the committee meeting.

(colombopage.com)