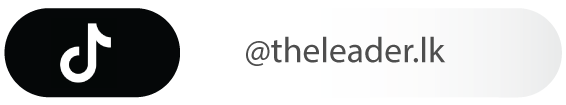

Three LCs opened in Bank of Ceylon (BOC) have been rejected by banks in the UK, Switzerland and New Zealand last week showing signs of the island nation’s bankruptcy and the country’s weakened credit profile, one of the top business leaders disclosed.

Apart from the prohibition of opening new LCs, banks have been directed to suspend the payment for already opened LCs before the enforcement of the import ban, they said, pointing out that it breaches Uniform Customs and Practice (UCP 600) regulations that govern international trade of banking.

Under this set up, the local bank which has opened the LC would be blacklisted in international trade for defaulting.

Sovereign’s weakened credit profile will affect Sri Lankan banks' sluggish economic activity, external and domestic vulnerabilities.

According to Fitch Ratings, the operating environment continues to have a high influence on bank ratings in Sri Lanka, as it affects the level of risk of doing business and banks’ financial and non-financials rating factors.

Muted private credit growth and the sovereign’s weakened credit profile are significant downside risks to the operating environment for Sri Lankan banks, Fitch Ratings added.

Fitch lowered its assessment of the operating environment score for Sri Lankan banks to ‘ccc’ with negative outlook from ‘b-‘ with a negative outlook, after the Sri Lanka sovereign rating was downgraded to ‘CCC’ from ‘B-‘ in November 2020.

The weaker sovereign credit profile could affect the banks’ operating environment, which is already weak due to the coronavirus pandemic.

State banks face the threat of being blacklisted by foreign banks

Sri Lankan businessmen are now experiencing difficulties in importing essential items and other items needed for their value added products on credit terms as foreign banks

begin reusing their Letters of Credit(LCs) opened in local banks, several business leaders said.