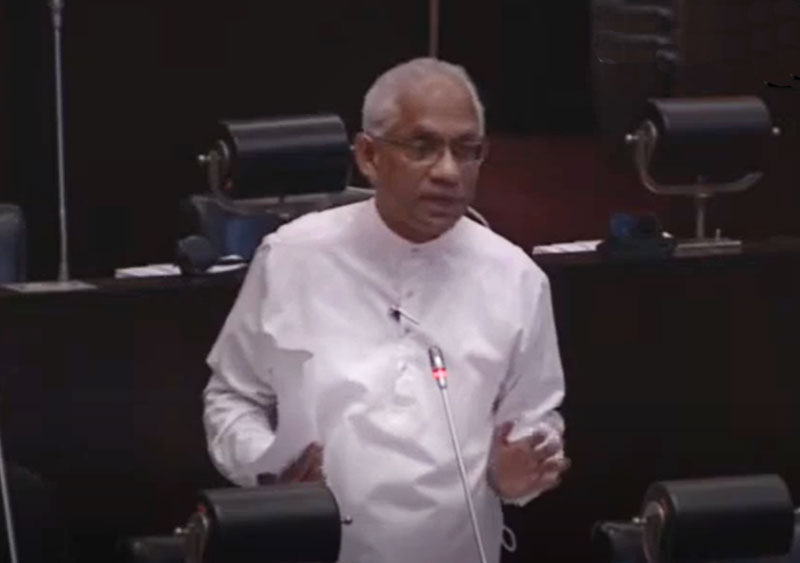

Former Finance Minister Ravi Kar-unanayake yesterday said Sri Lanka’s deal with the Inter-national Monetary Fund to unlock the $ 2.9 billion Extended Fund Facility (EFF) will be mainly building international reserves to meet external payments and support of macroeconomic adjustment and structural reform programs amidst economic and political crises.

Karunanayake, who in 2019 effectively handled $ 1.5 billion IMF bailout deal to boost foreign exchange reserves and avert a balance of payments problem, noted that it will be a catalyst to generate additional international financial assistance in three ways

He explained that a macroeconomic adjustment program with the IMF is often a prerequisite for obtaining World Bank, ADB and other multilateral adjustment loans.

Secondly, as part of entering into a stabilisation program, the IMF arranges aid consortia of donor countries to assist the country. Most of the donor funds received under these consortia are outright grants or long-term loans that carry low interest rates.

Thirdly, he said credibility of the economic reforms gained by entering into an IMF program helps raise funds at competitive interest rates from private capital markets.

The other significant benefit for the country after the unlocking of IMF EFF would be the breathing space it provides for the Government to make a series of delicate policy changes, Karunanayake said.

The IMF extends policy advice, capacity-building activities, and concessional financial support at below-market interest rates.

Debt relief from Sri Lanka’s creditors and additional financing from multilateral partners will be required to help ensure debt sustainability and close financing gaps.

Financing assurances to restore debt sustainability from Sri Lanka’s official creditors have been extended to the IMF and making a good faith effort to reach a collaborative agreement with private creditors were crucial before the IMF provides financial support to Sri Lanka.

“The Government will have to make these policy changes as fast as possible, in order to build a highly competitive, export-oriented economy,” Karunanayake said, adding that it has to prevent economic hardships for large sections of the population.

The Finance Ministry and the Central Bank authorities have devised the country’s economic reforms program in consolation and compromise with the IMF mission for Sri Lanka and it is expected to be endorsed by the IMF Executive Board at its meeting today (Monday 20).

There were 15 commitments made by the Government to the IMF, he pointed out, adding that the Central Bank and the Finance Ministry top officials had the opportunity to make many major tax reforms to raise Government revenue for fiscal consolidation.

Among these commitments were the cost-recovery based pricing for fuel and electricity, in order to minimise fiscal risks arising from public sector enterprises and the restructuring of some of these SOEs.

It has also suggested an increase in social spending and improvement in the coverage and targeting of social safety nets, aiding the poor and vulnerable.

Data-driven monetary policy, fiscal consolidation, phasing out monetary financing, and strong central bank autonomy to restore price stability, the market-determined and flexible exchange rate to restore foreign exchange reserves and allow for a flexible inflation targeting regime was another commitment made by the Government to the IMF

It has to ensure a healthy and adequately capitalised banking system, while upgrading the regulatory standards and safety nets in the financial sector.

Fiscal transparency, public financial management and laws/policies to reduce corruption vulnerabilities were also accepted by the Government.

Karunanayake says commercialisation of some of the State-owned enterprises (SOEs) will be required since their performance has declined largely because of corruption, mismanagement, and technical incompetence and it is essential expedite the restructuring process without allowing them to further burden the country.

(Daily FT)