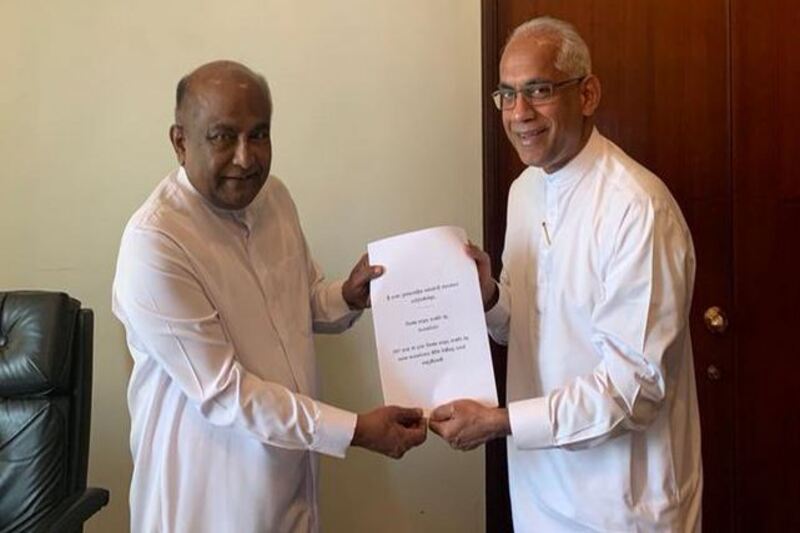

Former State Minister of Finance MP Eran Wickramaratne presented two private members' bills on March 08 to the Secretary General of Parliament to amend both the Value Added Tax Act No. 14 of 2002 (as amended) and the Special Commodity Levy Act No. 48 of 2007.

These two amendments seek to facilitate parliamentary control over public finance as constitutionality required, and prevent the executive (Minister) from abusing statutory powers, including by (corruptly) granting benefits to a chosen few.

"As the people of Sri Lanka are calling for more accountability and transparency with regard to public finances in the country, I have brought these two amendments to ensure parliamentary control on any changes to Value Added Tax (VAT) and to the Special Commodities Levy," adding that Sri Lanka’s parliament is constitutionally supposed to have full control over public finances as per article 148.

However, the SJB lawmaker pointed out that there is currently tax legislation that actually violates this imperative provision, and instead gives discretion to the minister on: (i) tax exemptions, (ii) tax base, and (iii) tax rate. This type of discretion is seen in two key tax acts, the Value Added Tax Act No. 14 of 2002 (as amended) and the Special Commodity Levy Act No. 48 of 2007.

Explaining further, he said;

"In both pieces of legislation, the minister has complete discretion to change taxation and simply announce it through a gazette notification. The decision to change taxation comes into effect immediately on the Minister’s signature and will only later be approved by Parliament. Even if it is not approved, whatever actions by the minister (eg. reducing VAT or SCL) through the Order cannot be reversed by parliament but only discontinued. This leaves an extraordinary amount of power in the minister’s hands and leaves room for the tax system to be abused in favour of vested interests and potential corrupt activities.

The well known sugar scam from 2020 is an example of the impacts of leaving the discretionary power with the minister. Prior to October 20202, sugar taxes were LKR 50 per kilogram of sugar, and were drastically reduced to 25cents per kg. This is a reduction of 99.5% taxes on imported sugar. The gap between the cost to the importer and the market price has increased substantially after the tax reduction. According to the National Audit Office of Sri Lanka, between October 2020 – February 2021, we have cumulatively lost LKR 16 billion in potential tax revenue. PublicFinance.lk has noted that the benefit of the tax reduction was not passed on to the consumer and importantly that Sri Lanka has lost approximately LKR 59 billion in cumulative revenue from October 2020 until December 2022 by cutting the SCL on sugar imports.

The discretionary power of the minister to make ad hoc changes to taxation can also have a serious impact on the country's economy. At a time when the country is facing a severe economic crisis, and when there are calls from the people to have more transparency and accountability of our public finances, it is imperative that parliament retains full control over public finance as mandated by Article 148 of the Constitution. Therefore, I have submitted these two amendments to amend the VAT and SCL to promote fiscal accountability and ensure that decisions on taxation are transparent and are discussed in the public domain."