Sri Lanka’s political parties have issued a joint statement calling on the government to take immediate action to find a lasting solution to the massive economic crisis facing the country.

The opposition lawmakers have called for a multi-step process to be initiated towards an orderly negotiated postponement and restructure of repayment of sovereign debt.

According to their analysis, the joint statement presented four major challenges related to the current economic crisis faced by the country.

These facts are presented in relation to the credit rating of Sri Lanka, the declining foreign exchange reserves, the expenditure on government loan interests and the increase in the country’s debt.

The Opposition noted that the country’s ratings have fallen to the level of being blacklisted in international credit markets. Since April 2020, Sri Lanka has been locked out of borrowing using International Sovereign Bonds (ISBs) In the International market, the statement said.

Repaying US dollar debt in this context means that the usable foreign reserves are down to below one month of imports — the lowest on record since independence, they said.

The ratio of interest on debt to government revenue was above 70% in 2020, a historical high for Sri Lanka, and amongst the highest in the world.

The ratio of public debt compared to the value of Sri Lanka’s domestic production (GDP) is also the highest on record, at 120%. It skyrocketed, by almost 25 percentage points, in the fast two years. Each of these situations by themselves would spell a serious economic challenge.

“Occurring simultaneously, this pressing and historic economic crisis is threatening our future, in both the short term and long term,” the joint statement said.

In such a context, we recognize the best way forward for Sri Lanka is to immediately initiate a multi-step process towards an orderly negotiated postponement and restructure of repayment of its sovereign debt.

“Sri Lanka can then correct its policies towards a path of sustainable economic growth and debt management, while also ensuring access to essential needs and goods for the Sri Lankan economy and Its people.”

Recognizing that undoubtedly the government has a daunting task ahead, the group said as a country there is a need for all to come together to overcome this challenge.

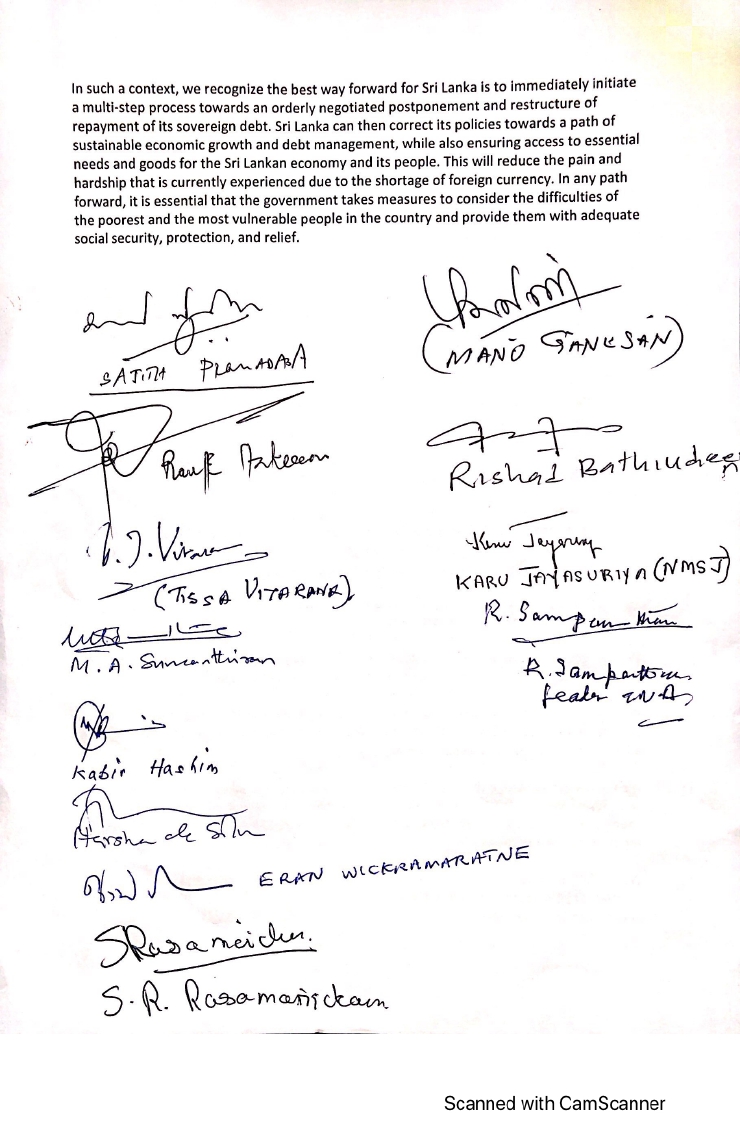

The joint statement was signed by the Leader of the Opposition Sajith Premadasa, MPs R. Sampanthan, MA Sumanthiran, Shanakkiyan Rasamanikkam for Tamil national Alliance (TNA), MP Rauf Hakeem for Sri Lanka Muslim Congress and MP Mano Ganesan, for the Tamil Progressive Alliance.

The joint statement was also signed by SJB MPs Kabir Hashim, Dr. Harsha de Silva, Rishad Bathiudeen and Eran Wickramaratne.

MP Prof. Tissa Vitharana on behalf of the Lanka Sama Samaja Party (LSSP) and former Speaker Karu Jayasuriya, Chairman of the National Movement for Social Justice (NMSJ) have also signed the joint statement.

The Opposition issued the statement to media following a discussion held in in late January. The discussion was convened by TNA MP MA Sumanthiran with the leaders of the opposition parties. (Colombo Page)

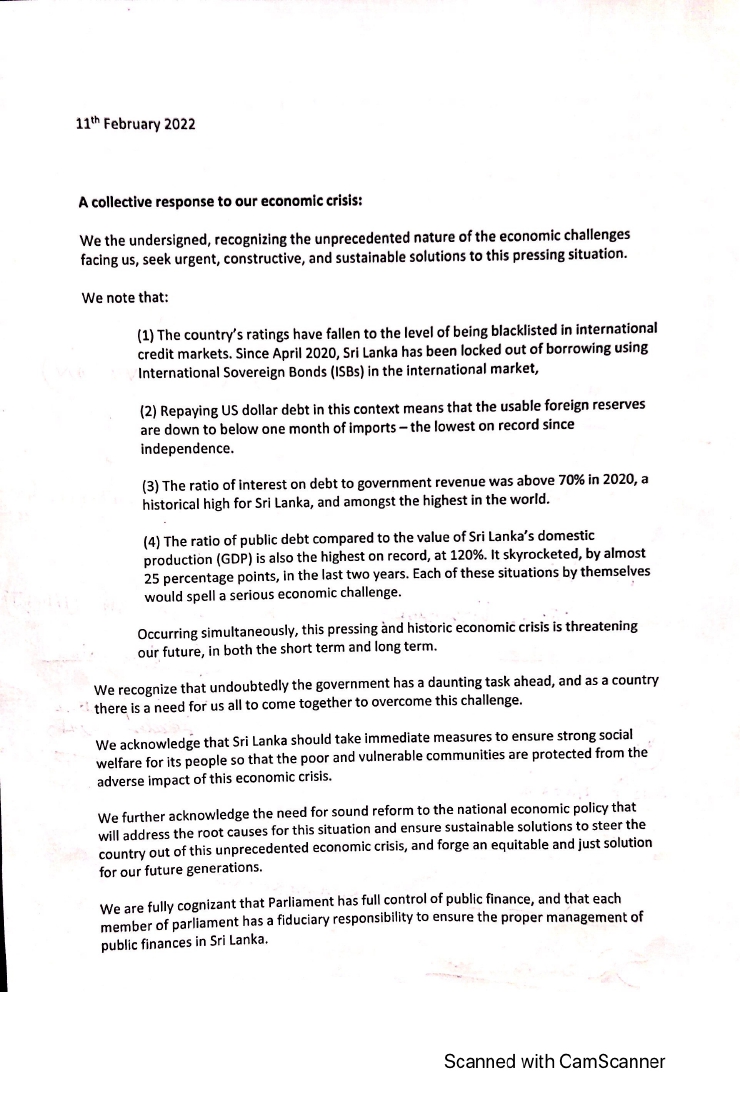

Following is the statement in full:

A collective response to our economic crisis:

We the undersigned, recognizing the unprecedented nature of the economic challenges facing us, seek urgent, constructive, and sustainable solutions to this pressing situation.

We note that:

(1) The country’s ratings have fallen to the level of being blacklisted in International credit markets. Since April 2020, Sri Lanka has been locked out of borrowing using International Sovereign Bonds (ISBs) in the International market,

(2) Repaying US dollar debt in this context means that the usable foreign reserves are down to below one month of imports – the lowest on record since independence.

(3) The ratio of interest on debt to government revenue was above 70% in 2020, a historical high for Sri Lanka, and amongst the highest in the world.

(4) The ratio of public debt compared to the value of Sri Lanka’s domestic production (GDP) is also the highest on record, at 120%. It skyrocketed, by almost 2S percentage points, in the last two years. Each of these situations by themselves would spell a serious economic challenge.

Occurring simultaneously, this pressing and historic’ economic crisis is threatening our future, in both the short term and long term.

We recognize that undoubtedly the government has a daunting task ahead, and as a country there is a need for’ us all to come together to overcome this challenge.

We acknowledge that Sri Lanka should take immediate measures to ensure strong social welfare for its people so that the poor and vulnerable communities are protected from the adverse impact of this economic crisis.

We further acknowledge the need for sound reform to the national economic policy that will address the root causes for this situation and ensure sustainable solutions to steer the country out of this unprecedented economic crisis, and forge an equitable and just solution for our future generations.

We are fully cognizant that Parliament has full control of public finance, and that each Member of Parliament has a fiduciary responsibility to ensure the proper management of public finances in Sri Lanka.

In such a context, we recognize the best way forward for Sri Lanka is to immediately initiate a multi-step process towards an orderly negotiated postponement and restructure of repayment of its sovereign debt.

Sri Lanka can then correct its policies towards a path of sustainable economic growth and debt management, while also ensuring access to essential needs and goods for the Sri Lankan economy and Its people.

This will reduce the pain and hardship that is currently experienced due to the shortage of foreign currency. In any path forward, it is essential that the government takes measures to consider the difficulties of the poorest and the most vulnerable people in the country and provide them with adequate social security, protection, and relief."