According to them, the multinational company had altered the name of the imported product and had brought in Palm Oil Fatty Acid into the country. They also revealed that the Cosmetics Manufacturers Association of Sri Lanka had submitted a written complaint on February 12, 2019, to the then Director-General of Customs, Mrs. P.S.M. Charles about the fraudulent act.

Letter sent by the President of the Cosmetics Manufacturers Association of Sri Lanka to the-then Director General of the Department of Customs.

When inquired by the Cosmetics Manufacturers Association of Sri Lanka, a senior official of the association stated that he had met the current Director-General of Customs, Retired Army Major General Vijitha Ravipriya, to remind him of their written complaint regarding the fraud. He said, however, the Sri Lanka Customs has not yet collected the fines nor the excise duties owed by the relevant multinational organisation.

Following the complaint of the Cosmetics Manufacturers Association of Sri Lanka, the former Director-General of Customs had ordered Superintendent of Customs D.K.S Raveendran to inquire into the matter. However, when asked by the Sunday Lankadeepa, he had stated that he has no authority to make a statement to the media in this regard.

The newspaper had then carried a news article titled “Customs feeling lazy to collect Rs. 1.5 Billion in Excise duties from Multinational” on February 14, 2021.

However, 'Sunday Lankadeepa' had taken care not to disclose the name of the relevant multinational company operating in the country or the correspondence with Superintendent of Customs D.K.S Raveendran.

However, Customs Department sources told us that the multinational company in question is 'Unilever Sri Lanka'.

Letter to the Customs and Response!

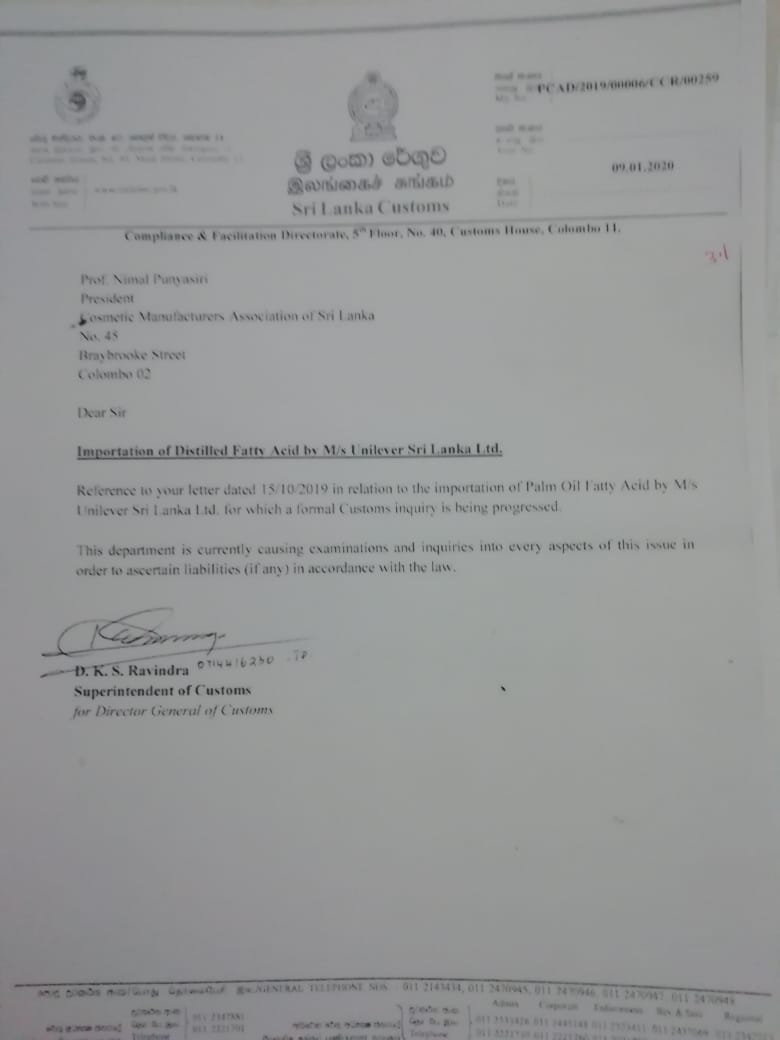

The letters sent by the President of the Cosmetics Manufacturers Association of Sri Lanka, Prof. Nimal Punyasiri to the former Director-General of Customs on 06 May 2019 and to the Superintendent of Customs, D.K.S Raveendran on 15 October 2019 as well as the response sent by Raveendran on January 09, 2020 can be found below.

Palm Oil Fatty Acid?

Palm oil is one of the main ingredients used in the manufacture of soaps and bathing bars. It is an imported raw material. From 2000 to October 08, 2018, Unilever has been importing palm oil fatty acids duty-free under the Indo-Lanka Free Trade Agreement.

Accordingly, the tax relief received by Unilever ranges from Rs. 650 million to Rs. 800 million per annum while Unilever's additional profit from those tax breaks over the same 18 years can be estimated at around Rs. 12 billion.

Local soap makers, however, say that while Unilever is entitled to such a large tax deduction they are not entitled to it and is therefore paying a 30% as customs duties for raw materials.

New customs duty for 2018!

However, on October 08, 2018, the then Ministry of Finance imposed a 25% customs duty on the import of palm oil fatty acids (HS-No. 3823.19.20). It came into force on October 9, 2018.

Unilever is now being accused of using a devious tactic to avoid paying the new customs duty.

Instead of the usual import of palm oil under the correct category of fatty acids (HS-No. 3823.19.20), it is being imported under the category of non-taxable HS-No. 3823.19.90.

Accordingly, there has been a clear customs duties evasion of around Rs. 570 million.

Complaint to the Customs!

In the face of this scenario, the Cosmetics Manufacturers Association of Sri Lanka not only wrote to the then DG of Customs, P.S.M Charles on February 12, 2019, about the customs duties' evasion but also noted that members of their association are importing palm oil fatty acids (HS-No. 3823.19.20) by paying the 25% customs duty as stipulated.

But even after the complaint, it has been revealed that Unilever did not pay its customs duties.

The Cosmetics Manufacturers Association of Sri Lanka has then taken steps to meet the Director-General of Customs again on March 18, 2019, and lodge yet another complaint.

Several senior Customs officials were also present at the discussion, where it was assured that investigations into the Unilever fraud would be launched soon.

Following Investigations, it has been revealed that Unilever had imported palm oil fatty acids (HS-No. 3823.19.20) fraudulently under code (HS-No. 3823.19.90) and by April 2019, evasion of customs duties by the multinational amounted to around Rs. 570 million.

Meanwhile, the Cosmetics Manufacturers Association of Sri Lanka had requested the Director General of Customs in a letter dated May 6, 2019, to recover the due customs duties expeditiously.

The 'Sunday Lankadeepa' reports that this customs duties evasion on the import of palm oil fatty acids is an estimated Rs. 1.5 Billion. However, customs sources say that the amount should be more than Rs. 2.2 Billion.

However, Unilever Sri Lanka denies all the allegations and has filed a case against Customs in the Court of Appeal under No. 19/2021, seeking an injunction restraining it from levying higher customs duties.